What is “home bias” and how could it affect your investment portfolio?

When you decide to invest your hard-earned money in the stock market, it is understandable that you’d prefer to know exactly where it is going.

Indeed, it can feel daunting to trust in the investment process, particularly now that finance is both globalised and digitised. To combat this feeling of uncertainty, many investors will choose their holdings in a biased manner – sometimes even without realising it. One common form of bias is known as “home bias”.

Home bias describes a leaning, subconscious or conscious, towards investing in assets within your home country. For instance, a UK investor may be more likely to buy shares in Sainsbury’s than in a US supermarket chain like Walmart.

While it is understandable that some investors from the US or China may always have a slight home bias, as these nations are home to a large portion of global equities, the Corporate Finance Institute (CFI) reports that home bias is just as present in emerging market nations as it is in larger countries.

Keep reading to find out why home bias is so prevalent, and a few ways it could affect your investment portfolio.

2 key reasons why investors could be biased towards domestic investments

Before we get to the effects of home bias on investment performance, it’s important to ask the question: “Why are we so often biased towards domestic holdings?”

Here are two key reasons.

1. You may feel as if your money is heading somewhere familiar

Although we can never truly control how an asset performs, investing in UK holdings might offer the illusion of safety and familiarity. When in fact, the level of risk an asset is exposed to can be determined by multiple factors, not just its geographical location. Two of these factors include:

- The type of investment you’re making. Some holdings are typically less volatile than others, although this can always change.

- The time frame over which you hold the asset. A number of studies, which we’ve explored in previous insights, reveal that investments held for a longer period of time may typically perform better than short-term holdings.

So, while it may feel natural to gravitate towards domestic stocks, doing so may not actually be “safer” for your money – something we’ll explore further later on.

2. Older generations may feel concerned about the security of foreign investments

According to Investopedia, one core aspect of home bias is that older generations may not trust the security of foreign investments.

Indeed, the report found that 45% of baby boomers have some form of home bias when investing, while only 24% of millennials do.

It is easy to forget that investing has only been digitised in the last 25 years. For those who are unfamiliar with the world of digital finance, opening your investment portfolio up to the global market could feel nerve-wracking.

Ultimately, though, it’s important to stay up to date and confident about expanding your horizons (while doing your own research with the help of a professional, of course).

While there is usually a capital risk involved, regardless of the geographical biases you hold, working with a financial adviser can help you feel more confident about growing your wealth through a globally diversified portfolio of assets.

Being biased towards UK investments could have a negative fiscal impact

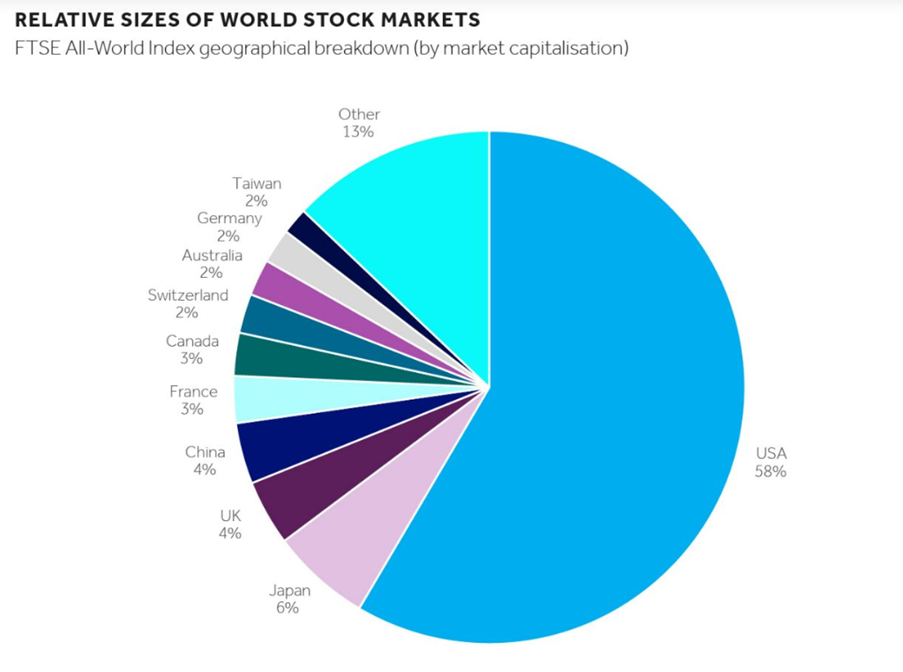

According to Barclays, British investors typically allocate 25% of their portfolio to domestic holdings, despite UK markets making up just 4% of world stock markets.

Sources: FTSE Russell, Barclays Private Bank, March 2023. Allocations below 1.5% have been put into “Other”.

When a vast array of investment opportunities lies before you, narrowing your choices to just 4% of the market may mean you’re missing out on avenues that could help you grow your wealth over time.

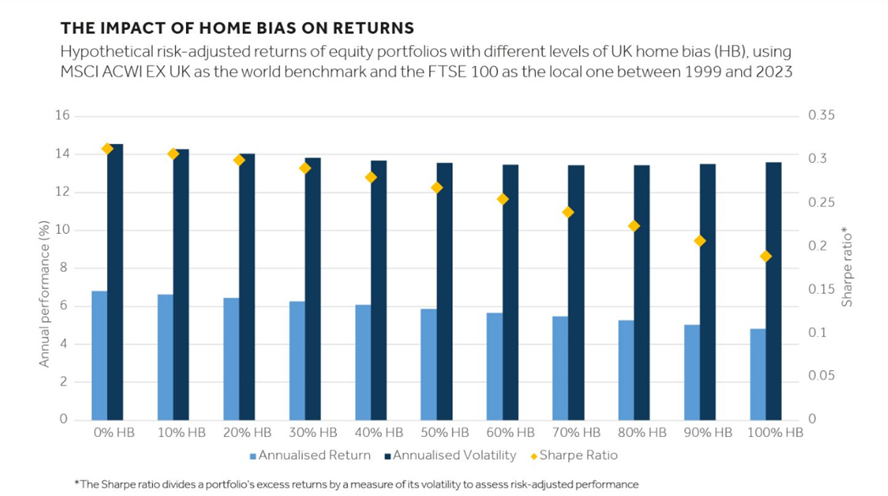

In fact, the report produces evidence that home bias has historically had a negative impact on returns.

Using the Sharpe ratio – which divides a portfolio’s growth by a measure of its volatility to produce a non-adjusted projection of returns – the below graph reveals that between 1999 and 2023, home bias had a staunchly negative effect on portfolio performance.

Source: Bloomberg, Barclays Private Bank, March 2023.

Over this time period, the UK’s FTSE 100 index underperformed compared to the MSCI World Index, resulting in lower adjusted returns for investors who leaned towards UK holdings.

Although past performance is not a reliable indicator of future performance, and this example is historical, this 24-year trend indicates that home bias may be more than just a psychological phenomenon – it could actually hurt your portfolio’s chances of growth too.

Working with an impartial financial professional could help reduce your investment bias

As you read earlier, investing with home bias is often an unconscious act. We naturally gravitate towards the familiar, so if you’re beginning to realise that your investment portfolio leans heavily towards domestic holdings, you are not alone.

Moreover, working with an unbiased financial adviser could be constructive, helping you to broaden your horizons and invest your wealth in line with your goals. With decades of collective market experience, our advisers can:

- Listen carefully to your concerns about foreign investments and offer evidence-based guidance

- Help you purchase holdings that suit your appetite for risk and desired time frame

- Instil you with the knowledge you need to invest in non-UK assets with confidence.

To speak with a professional who will put your goals at the heart of the conversation, email info@chancellorfinancial.co.uk, or call 01204 526 846 to speak to an adviser.

If you’re already a client here at Chancellor, contact your personal financial adviser to discuss any of the content you’ve read in this article.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.